42+ what percent of income should mortgage be

Web What percentage of your monthly income should go to mortgage. Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and insurance.

For Sale 158502 7th Line Meaford Ontario N4l1w5 X5924389 Realtor Ca

Is a Maryland corporation that has elected to be taxed as a real estate investment trust.

. Web What percentage of income do I need for a mortgage. Ad 5 Best House Loan Lenders Compared Reviewed. Web The 28 rule.

Compare More Than Just Rates. Compare More Than Just Rates. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment.

A lender suggests to not. Find A Lender That Offers Great Service. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

New York Mortgage Trust Inc. Web Keep your mortgage payment at 28 of your gross monthly income or lower. Web Most lenders must follow strict policies that limit a mortgage payment to a lower percentage that commonly being 28 percent.

Keep your total monthly debts including your mortgage payment at 36 of your. Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income. Mary has an average.

The 28 rule specifies that your mortgage payment shouldnt be more than 28 of your monthly pre-tax income. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including. Looking For a House Loan.

Web How much of your income should go toward a mortgage. Anything above that amount the average earner might find their financial situation a little. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

To find your maximum mortgage. Use Our Tool To Find Out If You Qualify. Web As the name suggests this rule states that no more than 28 percent of your gross income should go toward your monthly mortgage payment.

Web 1 hour agoNon-GAAP operating income was 52 billion up 11 from last year. A general rule of thumb for homebuyers is your home loan should eat up no more than 28 of your pre-tax. The 2836 rule is a good benchmark.

Web Once the average income is determined a mortgage lender will confirm the DTI and recommend an eligible monthly mortgage payment. Web 15 hours agoAbout New York Mortgage Trust. Web Ideally no more than 33 of your net monthly income should go to housing costs.

No more than 28 of a buyers pretax monthly income should go toward. So if your gross. However your housing costs dont end with your rent or mortgage payment.

A conservative approach is the 28 rule which suggests you shouldnt spend more than 28 of your gross monthly. Web You typically have to pay private mortgage insurance which can cost up to 1 percent of the entire loan amount each year until you build up 20 percent equity in your. Comparisons Trusted by 55000000.

Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the. Ad Compare Home Financing Options Get Quotes.

Web However the general rule is 28 of your income should be funnelled into your mortgage. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Use Our Tool To Find Out If You Qualify.

Ad Compare Home Financing Options Get Quotes. Find A Lender That Offers Great Service. Compare Lenders And Find Out Which One Suits You Best.

The operating margin including Cerner was 42 as we continue to integrate Cerner in the. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Save Real Money Today.

Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance.

8797 N Us Highway 31 Free Soil Mi 49411 Mls 23000935 Zillow

Cities With The Highest Share Of Income Going Towards Mortgage Payments Hireahelper

Do You Really Need Lots Of Income For A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports

What Percentage Of Your Income Should Go To Your Mortgage Hometap

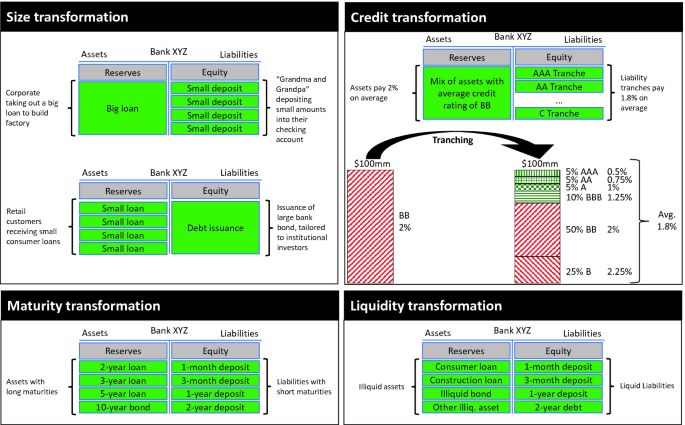

Fundamentals Of The Banking Business Springerlink

42 Sample Budget Checklists In Pdf Ms Word

Fundamentals Of The Banking Business Springerlink

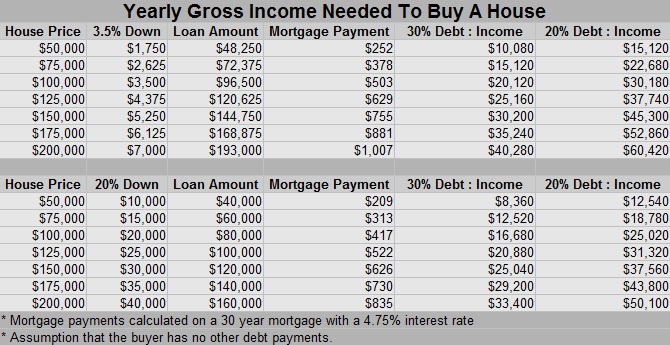

This Is The Income You Need To Afford A Home Really Action Economics

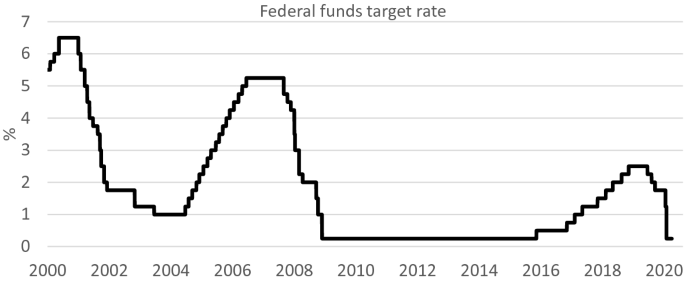

Econ 2101 Wholework Answer Econ2101 Microeconomics 2 Unsw Thinkswap

Your Rent Should Be 10 Of Your Income How Much To Spend On Housing Johnnyfd Com Follow The Journey Of A Location Independent Entrepreneur

What Percentage Of Your Income Should Go To Mortgage Chase

What Percentage Of Your Income Should Go To Your Mortgage Hometap

Ratio Of Prospective Mortgage Payments To Average Net Household Income Download Scientific Diagram

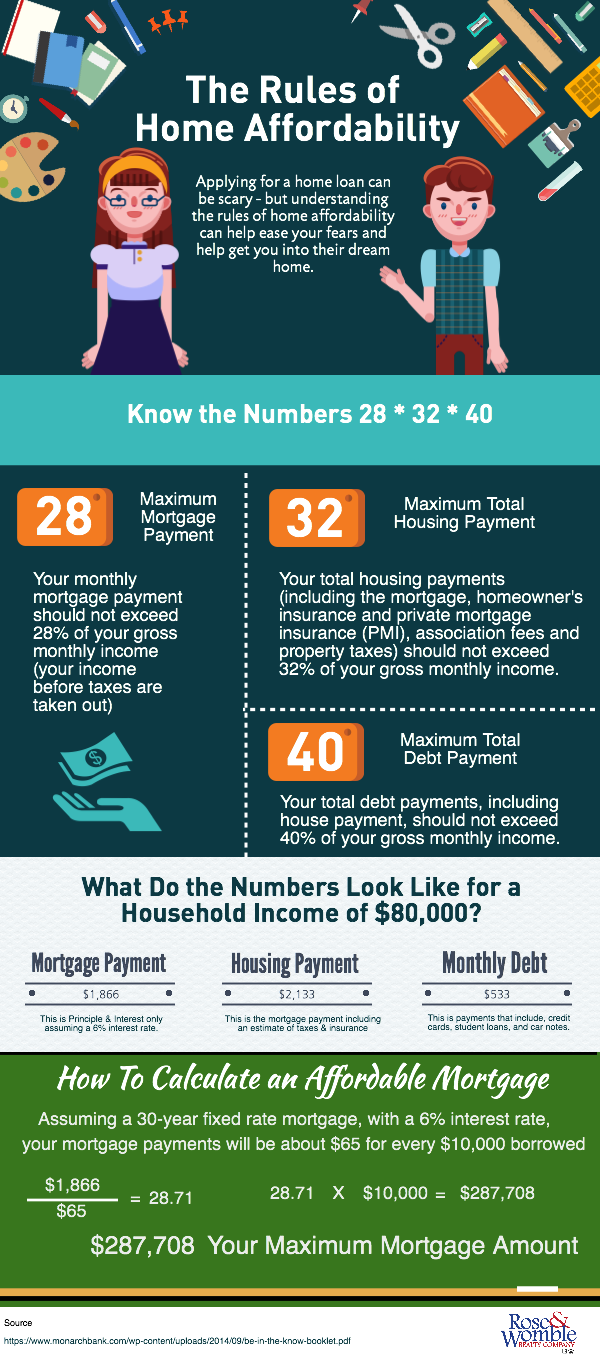

Mortgage School The Rules Of Home Affordability Rose Womble Realty Co

2gq6r 4y3yxqkm

Solved Kim And Kanye Go Kayaking Kim Heads Due East For 5 0 Km At The Course Hero

Mortgage Broker Southport Labrador Ashmore Surfers Mortgage Choice