W2 hourly rate calculator

1099 vs W2 Income Breakeven Calculator. For example a W-2 employee with no benefits and a wage of 25hour would expect to make about 27hour 25 x 10765.

Hourly To Salary Calculator

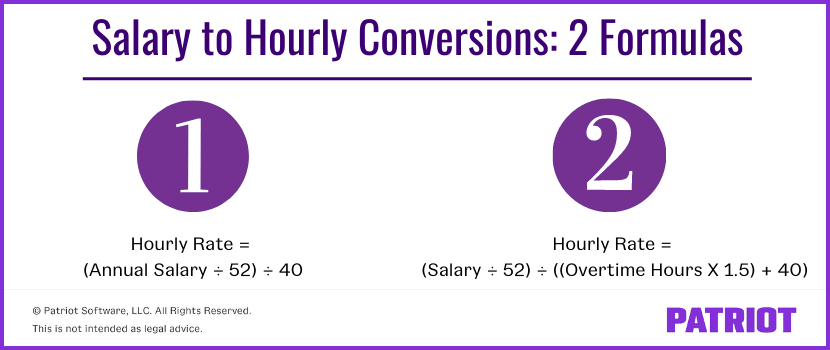

To keep the calculations simple overtime rates are based on a normal week of 375 hours.

. Find out the benefit of that overtime. How do I calculate hourly rate. Ad Get Started Today with 2 Months Free.

Since this is a full time employment usually for calculation purpose you can take there are 2000 working hours in a year. As the employer you must also match your employees contributions. - A Annual salary HW LHD 52 weeks in a year - B Monthly salary A 12 - C Weekly salary HW LHD What is minimum wage.

Under FICA you also need to withhold 145 of each employees taxable. Ad Create professional looking paystubs. There are two options in case you have two different overtime rates.

Enter your info to see your take home pay. Use this tool to. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

More information about the calculations performed. Let us help you figure that out. Using a 30 hourly rate an average of eight hours worked each day and 260 working days a year 52 weeks multiplied by 5 working days a week the annual unadjusted salary can be calculated as.

1 Use Our W-2 Calculator To Fill Out Form. Estimate your federal income tax withholding. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

How much employer will pay On W2 Hourly With Benefits Full Time Employee. Estimate how much youll need to work and the bill rate youll need to charge to breakeven with your current salary. You can also determine the annual salary of an employee by multiplying their hourly wage by the number of hours they work in a year.

Which is equal to both the employee and employer portions of the FICA taxes 153 total. Payroll So Easy You Can Set It Up Run It Yourself. See how your refund take-home pay or tax due are affected by withholding amount.

So if an employee makes 15 an hour working 40 hours a week they make about 31200. Keeping this in mind we can calculate a sustainable 1099 hourly rate that will keep you and your clients happy. A 1099 contractor making 35hour would then expect to make about 3250hour 3510765.

Days Worked Per Week week. Use this calculator to easily convert a salary to an hourly rate and the corresponding daily wage monthly or weekly salary. Net W2 Earnings - - Expected Independent Bill Rate.

How It Works. Freelancers have several expenses that W2 employees arent subjected to and to keep your business profitable these expenses need to be covered by your income. See where that hard-earned money goes - Federal Income Tax Social Security and other deductions.

Use it to estimate what hourly rate you need to get to a given salary yearly monthly weekly etc in other words calculate how much is X a year as a per hour wage. For example how does an annual salary as an employee translate to an hourly rate as a contractor. The difference in SE tax is that as a W2 the payer will be paying 12 the SE tax where as a 1099misc the reciever will be paying that SE tax so absent any expenses 1000 as a 1099misc will always be less after tax cash than 1000 in wages.

For example if an employee has a salary of 50000 and works 40 hours per week the hourly rate is 500002080 40 x 52 2404. For example for 5 hours a month at time and a half enter 5 15. Based on a standard work week of 40 hours a full-time employee works 2080 hours per year 40 hours a week x 52 weeks a year.

Monthly Healthcare Contribution month. The maximum an employee will pay in 2022 is 911400. Next divide this number from the annual salary.

Calculate your business expenses. Ad 1 Fill Out Fields Make an IRS W-2 2 Print File W-2 - Start For Free. Choose an estimated withholding amount that works for you.

So the employer will pay 2000 40 per hour. Compare your income and tax situation when you work as a W2 employee vs 1099 contractor. All Services Backed by Tax Guarantee.

Get Your Quote Today with SurePayroll. 30 8 260 62400. Transitioning from being an employee to being a contractor can take some thought.

2017-2020 Lifetime Technology Inc. Enter the number of hours and the rate at which you will get paid. The second algorithm of this hourly wage calculator uses the following equations.

First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. Luckily when you file. Salary to Hourly Calculator.

We use the most recent and accurate information. Base Salary year. That being said althougha lot of companies may attempt to give the option or frame it as a choice.

Hourly Rate hour. Monthly Health Insurance Premium. Use this calculator to view the numbers side by side and compare your take home income.

50 of 80 is 40. 2 File Online Print - 100 Free. So the employer will pay 50 of 80 40 per hour to the candidate.

Hours Worked Per Day day. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. In a few easy steps you can create your own paystubs and have them sent to your email.

Just enter in a few details below to find out what hourly rate you should target. Within United States employees must be paid no less than the minimum wage as specified by the Federal and the local governments. Federal income tax rates range from 10 up to a top marginal rate of 37.

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Salary To Hourly Calculator Hot Sale 52 Off Www Wtashows Com

Printable 25 Printable Irs Mileage Tracking Templates Gofar Vehicle Mileage Log Template Sam Report Template Templates Professional Templates

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Salary To Hourly Calculator Hot Sale 52 Off Www Wtashows Com

How To Convert Salary To Hourly Formula And Examples

Capacity Planning Template In Excel Spreadsheet Excel Spreadsheets Spreadsheet Excel Spreadsheets Templates

Employee Cost Calculator Updated 2022 Employee Cost Calculation

Hourly Rate Calculator

3 Ways To Calculate Your Hourly Rate Wikihow

Hourly To Salary Calculator Convert Your Wages Indeed Com

With Stubcreator Com Reliable Pay Stubs Are Generated Instantly Which Are Available For Print At The Same Time All Thanks To Its Paycheck Salary Calculator

Hourly Rate Calculator

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Salary To Hourly Calculator Hot Sale 52 Off Www Wtashows Com

Hourly Wage Then Log Download Pay Stub Template Word Free With Regard To Pay Stub Template Word Document Cumed O Word Free Microsoft Word Templates Templates

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax